THE PROBLEM/CHALLENGE:

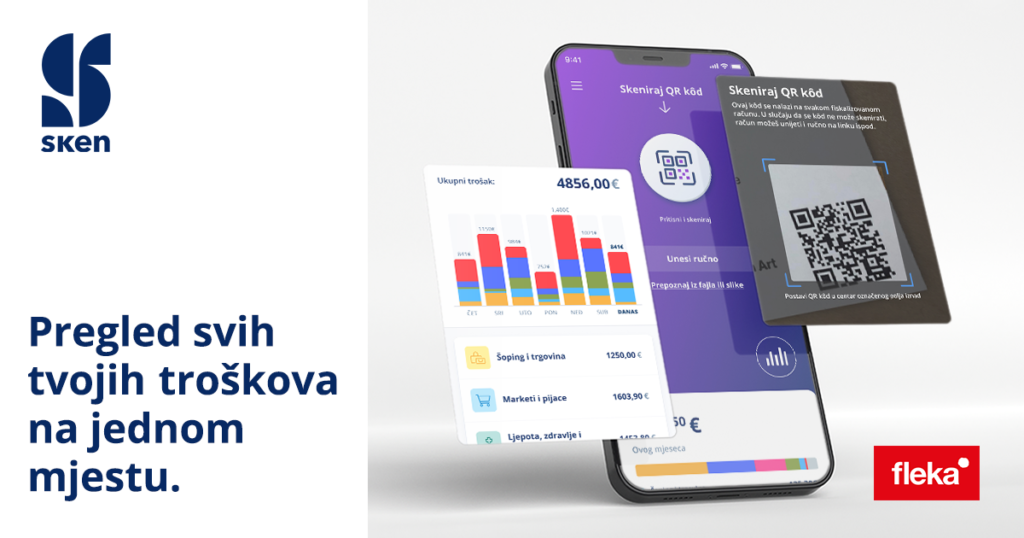

Montenegrin company Fleka and Faculty of Information Systems and Technologies UDG, are working on the project “Personalized Banking Software Solutions”, which is partly funded by Innovation Fund of Montenegro. The project is centred around the development of a set of SaaS solutions, based on machine learning and data collection, which will enable financial institutions and other companies to significantly improve personalized banking and payment services for their clients. Fleka previously developed SKEN mobile application, a personal expense tracker that helps users keep track of their spending by scanning fiscal receipts which are automatically categorized by the system.

SOLUTION:

This new solution aims to be integrated with their existing mBanking and eBanking applications, with minimal effort, and will allow their customers to see their transactions in the new light. Instead of seeing it as just a chronological list, they will be able to have detailed insight, including category –specific expenditures breakdown, without requiring any additional effort on user’s behalf. The system will manage to categorize each transaction automatically using available public information, crowdsourced inputs and intelligence, and, most importantly, machine learning models. The consortium has jointly developed an advanced machine learning system that will significantly improve existing categorisation of expenses. It leverages the vast dataset collected by the SKEN app, and apply the team’s know-how, as well as research-derived expertise in data science and machine learning (ML) possessed by the HPC NCC and FIST experts.

Faculty of Information Systems and Technologies (FIST) UDG and NCC Montenegro experts developed ML classification algorithm based on NLP. Algorithm analyses collected data and classifies them into predefined categories (food, drinks, services …) based on annotated datasets. Generated reports will provide assembled and detailed overview of expenses by itemized categories, customers, and companies.

BENEFITS:

- Personalization: The integration of machine learning and data collection into the banking software will allow higher personalization in banking and payment services. Clients can receive tailored insights and recommendations based on their spending patterns, enabling them to make better-informed financial choices/decisions.

- Improved User Experience: With automated categorization of transactions clients can easily understand their spending habits and financial trends, contributing to their better financial discipline and planning.

- Data-driven business decisions: For financial institutions and companies, the categorized and analyzed data can offer valuable insights into customer behavior and spending preferences. These data support strategic decisions related to product offerings, marketing campaigns, customer targeting, financial management.

CONTACT:

EUROCC Montenegro

National Competence Centre for High-Performance Computing

University of Donja Gorica

Oktoih 1, 81000 Podgorica

Montenegro