THE PROBLEM/CHALLENGE

PAID MNE specializes in crafting scalable software solutions for investment firms, leveraging advanced algorithms, machine learning, and artificial intelligence to optimize trading strategies and risk management. Their PAID-T trading solution dynamically adapts to market fluctuations, offering optimized trading experience.

INVT provides software development services with an emphasis on AI innovation. Their multidisciplinary team pushes IT solution boundaries to maximize user benefits across various sectors.

The PAID-T (Price Action Intelligent Detection Trading) project faced a technical challenge in optimizing complex trading algorithms by running millions of simulations to fine-tune parameters for precise asset price prediction. This required processing minute-level OHLC datasets for multiple trading pairs, exceeding standard system capabilities. The solution involved scaling from single-node multiprocess execution to a multimode HPC environment, necessary for performance optimization and efficient resource management.

SOLUTION

To optimize trading algorithms with complex parameters, the LUMI supercomputer’s capabilities were leveraged. Project dependencies were adapted to align with LUMI’s default Python module, ensuring seamless compatibility. Multinode execution was enhanced using mpi4py with a task-pull paradigm, implementing a state machine with a master-worker model for efficient task distribution and execution. This enabled real-time result collection and resource optimization, achieving 1.2 million simulations in 4.7 hours, with single simulations reduced to 54 seconds and parallel runs averaging 58 seconds, showcasing substantial improvements in speed and efficiency. The integration of the LUMI supercomputer capabilities has transformed PAID’s financial market analysis. Previously constrained by standard computing resources and lengthy processing times, the system now enables rapid processing of billions of historical transactions. This enhancement enables the efficient identification of critical market patterns, providing a strong foundation for optimizing trading strategies with precision.

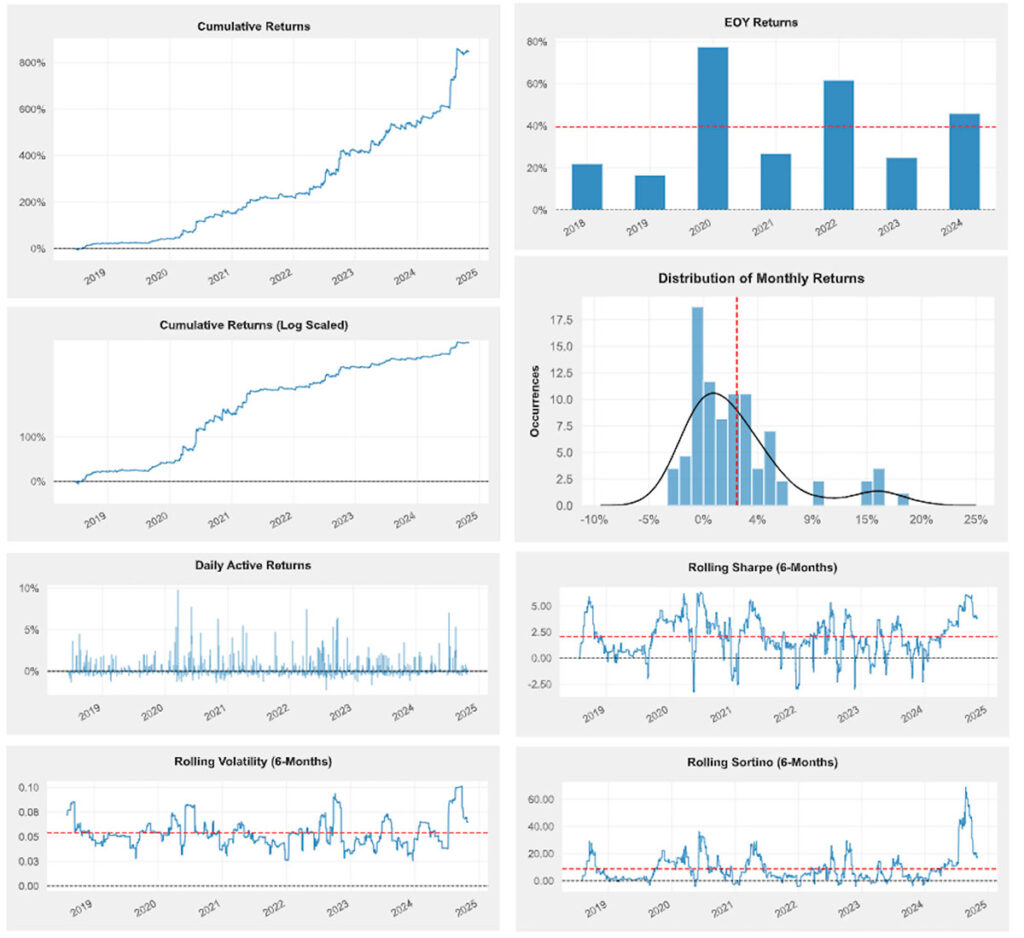

HPC-powered simulations have enabled the refinement of trading strategies across diverse market conditions, consistently achieving and exceeding key performance indicators (KPIs). Target KPIs assumed an average annual return of 30%, with maximum drawdowns remaining below 10% and contained within a single quarter. Additionally, maintaining a Sharpe ratio of at least 1.5 and a Sortino ratio of at least 2 are essential benchmarks, achieved through advanced computational insights and the robustness provided by supercomputer LUMI.

These advancements will support substantial business growth by improving the reliability of investment strategies. Enhanced analytical capabilities, powered by high-performance computing, strengthens market adaptability and competitive edge in the financial sector.

BENEFITS

- Time savings – Reduced data analysis time from several days to just hours, enabling faster decision-making and improved responsiveness.

- Product optimization – Enhancing the effectiveness, accuracy, and reliability of trading strategies.

- Cost Efficiency – Optimized resource utilization, minimizing wastage while maximizing computational performance and output.

NCC Montenegro assisted Paid MNE in applying for and obtaining HPC resources on the Lumi supercomputer.